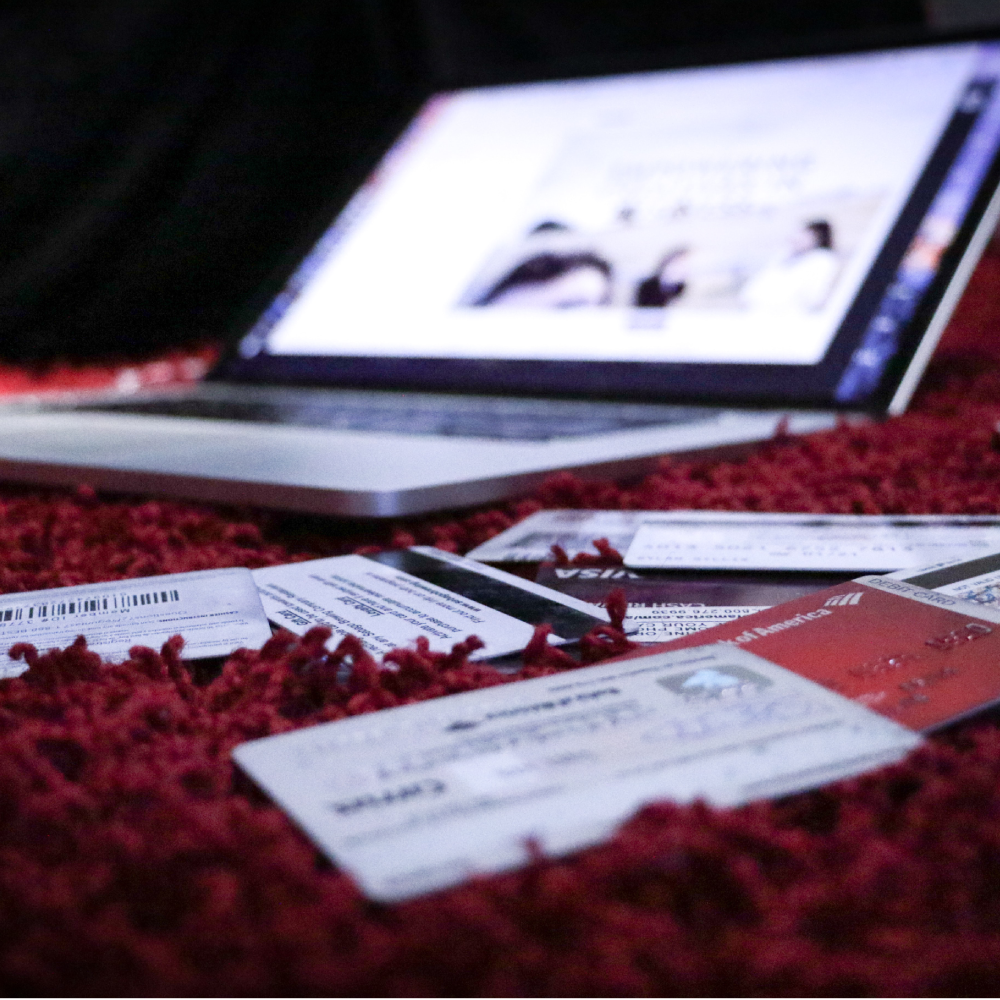

Debt settlement companies often promise to help consumers reduce their debt and get out of financial trouble. While some of these companies may provide legitimate services, others may use deceptive or unethical practices to make a profit. Here are some things that debt settlement companies may not want you to know.

First, debt settlement companies may not be upfront about the fees they charge. These fees can be significant, and they can add to your overall debt burden. In some cases, the fees charged by debt settlement companies may be higher than the amount of savings you receive from settling your debt. It is important to carefully read and understand the fee structure of any debt settlement company you are considering using and to compare it to other options for dealing with your debt.

Another thing that debt settlement companies may not want you to know is that their services may not be as effective as they claim. Debt settlement companies often promise to reduce your debt by a significant amount, but this is not always the case. In some cases, the savings you receive from settling your debt may be less than the fees charged by the debt settlement company. Additionally, some creditors may not be willing to negotiate with a debt settlement company and may continue to pursue collection efforts against you.

Debt settlement companies may also be less than forthcoming about the potential negative impact on your credit score. While settling your debt may reduce your overall debt burden, it can also damage your credit score. When you settle a debt for less than the full amount, the creditor will typically report the settlement to the credit bureaus as a partial payment. This can lower your credit score and make it more difficult to obtain credit in the future.

Additionally, debt settlement companies may not provide you with information about the potential risks and drawbacks of using their services. For example, they may not tell you that if you stop making payments on your debts to save up money for a settlement, you may be sued by your creditors or have your wages garnished. They may also not tell you that if you are unable to reach a settlement with your creditors, you may end up in worse financial shape than you were before.

Finally, debt settlement companies may not be transparent about their own business practices. In some cases, these companies may use aggressive or unethical tactics to pressure consumers into signing up for their services. They may also make false or misleading statements about their ability to help consumers reduce their debt. It is important to thoroughly research any debt settlement company you are considering using and to read customer reviews before making a decision.

In conclusion, debt settlement companies may not be as transparent or ethical as they claim. They may not disclose important information about the fees they charge, the potential effectiveness of their services, the negative impact on your credit score, the risks and drawbacks of using their services, and their own business practices. It is important to carefully research any debt settlement company you are considering using and to compare it to other options for dealing with your debt. By doing your homework, you can protect yourself from potentially harmful or deceptive practices.